CASE STUDY 2

Client Profile

Client: Retired (60-65), Financially well off but not well versed

Situation:Seeking guidance on financial self-care, Age related health issues, Needs help with well-structured investment plan.

Oftentimes, we tell our clients to steer clear of financial stress and never let this tension steer them to the point of inaction. Instead, we always motivate them to take back control of their life and avoid sailing through the murky waters.

This specific client that we are discussing here took quite a few months to build her trust in our judgment and competence. It tested our patience, but we did not give up. After several visits to our cozy office, a series of meetings, and long conversations she finally became a part of our Investaffairs family. Someday, we will post a piece on her point of view and thoughts too.

We always tell our prospects and investors if they are unable to figure out the root cause of the financial gap and do budgeting on their own then they can certainly do with some help in finding the correct long-term solution. One might be acquainted with the more traditional methods per se, like banking procedures, concept of recurring deposits, fixed deposits, post office savings but when it comes to investment vehicles like mutual funds, it is a different ball game altogether.

Before falling prey to the vicious cycle of financial stress please seek help like you would do in case of an ailment. We are fortunate that our highly academic client identified her challenges and came to us without wasting time. It is important to mention here that our client has a very affectionate husband and a daughter who is a careerist. She is a very independent woman and not at all suffering from SRS i.e. Sudden Retirement Syndrome. Does not suffer from sense of lack of purpose either. Her problem is that she is probably the only one in her family of three who seems to be serious about the future and doesn’t want to get entrapped into financial predicament.

The first exercise that we make our clients take up when they finally decide to make us custodians of their portfolio is to write down every detail of their expenditure, monthly, yearly, that may include minutest detail about spendings related to eating out on weekend or expenses related to pet grooming, pet food, doctor visits, parlour visits, shopping for clothes, jewelry, shoes etc. etc. When our sixty something lady was asked to go through the drill, she was initially a bit reluctant to disclose everything pertaining to her lifestyle but ultimately understood the importance of it. The sole purpose of disclosing the financial status to Investaffairs is to understand the difference between your ‘needs’ and ‘wants’.

For instance, she needed to follow a few rules (specific to this case) to reduce her stress:

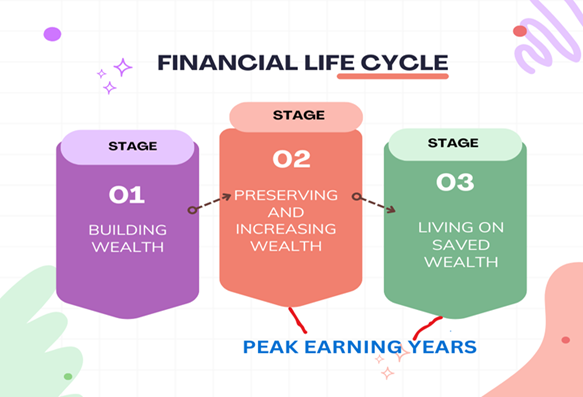

It is very important to understand the basic format of the financial life cycle for every individual which is characterized by different life events.

STAGE 1- Building Wealth

STAGE 2- Preserving and Increasing Wealth

STAGE 3- Living on Saved Wealth.

In this piece, it is very clear that we are talking about a client who needs guidance in making timely and well-informed decisions to pedal smoothly through Stage 2 and Stage 3 of the cycle. The household head (sole earning member) or both partners (spouses) have accumulated substantial wealth and are approaching retirement or are already retired. The second stage can be also considered as a critical phase whereby one needs to hone his /her money management skills.

What works best at Stage 2 is the desire and discipline to invest. Your financial experts (in this case experts at Investaffairs), put your plans into action. You must trust them as they are the ones who will put your money to work and potentially build your wealth. Our client had a bunch of doubts which were clarified while explaining the entire process. It takes time when a client’s math is weak, but no one is in a rush here. We are talking about money, someone’s hard earned money so that needs to be dealt with a lot of respect. There are terms like safety, liquidity, capital gains, income, associated with Mutual Fund investments objectives, which are an essential part of conversation in such cases.

Once our client entrusts us with the job of creating and developing their portfolio it becomes our responsibility to create a tailor-made investment plan for them. To make Stage 3 of the financial cycle more convenient for our clients, our personal finance managers conduct a periodic review of the portfolio and align the investment plan with the existing or new goals. Although the rule of 25x is the thumb rule when it comes to retirement savings, where you need to save 25 times your annual expenses, still it is neither too late nor too early when it comes to retirement planning.

At Investaffairs you are always welcome to discuss your plans and seek our help. We are as eager as you to find the solutions. Our intention and aim is to provide an impetus to total portfolio value. Presented below is the rough blueprint of how our team executes it: Key Components of Our Financial Management Approach: Re-Evaluating Retirement Lifestyle

Identify Financial Goals: Define clear financial objectives.

Set Timelines: Establish deadlines for achieving each goal.

Investment Strategy: Balance growth and accessibility of funds.

Wealth Protection: Minimize risk while safeguarding assets.

Emergency Fund: Build a reserve for unforeseen expenses.

Debt and Equity Management: Optimize the mix of debt and equity investments.

Structured Goals: Provide a well-defined structure to our client’s financial aspirations.

Adapt to Changed Circumstances: Motivate our esteemed clients to utilize their newfound time effectively.

CONCLUSION: This case study highlights the journey of a retired client who, despite being financially well-off, needed guidance to navigate the complexities of financial self-care and investment planning. At Investaffairs, we emphasize the importance of understanding individual financial goals and crafting personalized strategies to achieve them. By meticulously tracking the expenses of our client and distinguishing between her ’needs’ and ‘wants’, we helped her gain clarity and control over her financial situation.

Having said that, our structured approach, including clearing debts, curbing impulsive spending, and aligning investment strategies with her goals, helped to set her on a path to financial stability and peace of mind. At Investaffairs, our mission is to support our clients through every stage of their financial journey, ensuring they make informed decisions and achieve their financial aspirations. This case study is a testament to the effectiveness of our tailored approach and the transformative power of sound financial management. We encourage all our clients to seek guidance proactively, much like our featured client, to avoid the pitfalls of financial stress and secure a prosperous future

KEY WORDS: INVESTAFFAIRS, RETIREMENT, FINANCIAL SELF-CARE, FINANCIAL GAPS, BUDGETING, LIFESTYLE EXPENSES, CREDIT CARD DEBTS, IMPULSIVE SPENDING, WEALTH PRESERVATION, FINANCIAL GOALS, EMERGENCY FUNDS

Disclaimer: The data and information has been sourced from various domains available to the public. We have taken utmost care to represent the same as factually as has been made available. Please do not make any decisions based on our blogpost. Kindly check the data & information independently. For further guidance on finance and investment please reach out to our experts at Investaffairs.

If you have any Personal Finance query, do write to us

Categories

Recent Posts